Making a purchase is now faster than it ever was before, and this can be incredibly beneficial. No longer do people have to wait around while others enter their card codes in physical stores. Online shopping is even faster than that; automated checkouts and the ability to make a payment in person with just the tap of a card through contactless payments means that there really doesn’t need to be much to do! However, this new type of rapid payment is not always the blessing that it might seem to be.

Why Automated Spending can be Problematic

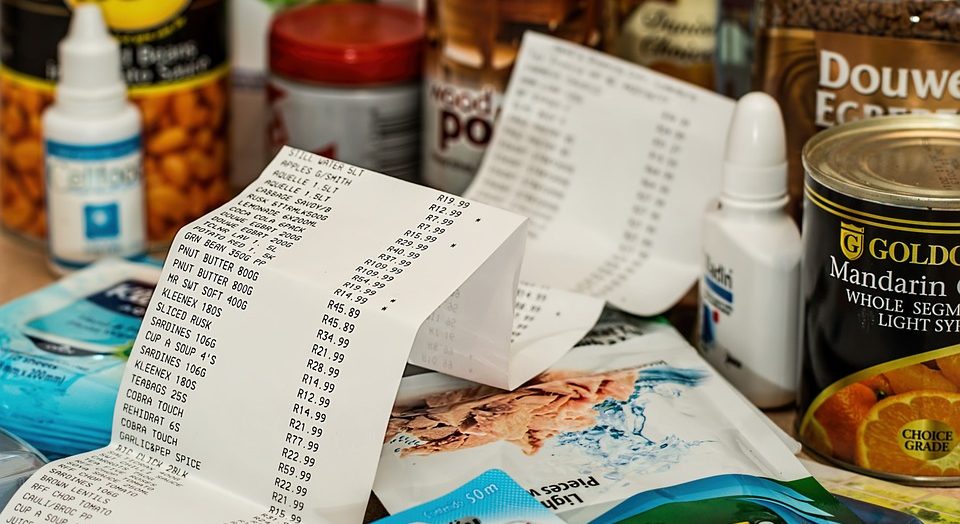

The introduction of automated spending methods can be, unfortunately, both a blessing and a curse for different reasons. In an ever busier world, anything that can save us time is usually considered to be a useful invention—however, these automated spending methods can also make it hard to keep track of your finances. Little payments, in particular, can be made “under the radar”; if not kept a close eye on, these can add up to hundreds of dollars spent unknowingly over a period of time.

“This is most notable at certain times of year, especially in the case of Christmas. There is so much pressure on people to spend big over the holiday season. Money needs to be spent to buy gifts for family and work colleagues and friends.We notice almost 200% increase on our sales in the holiday season,”says Sam Bourgan,owner of Newswatchngr, a product review portal. In addition to this, the cost of time off from work over the festive period and even the expense that is food shopping for family celebrations can quickly add up to your hard earned funds dwindling away—and without handing over physical cash, you might not know quite how much you are actually spending.

The Christmas Curse: Money Worries after the Holidays

Due to all of the pressures—including giving out cards and gifts and providing Christmas meals for all of the family—that are expected of people over the Christmas period, costs can rapidly spiral out of control. Once upon a time, though, managing the expense of the holidays wouldn’t be so hard. Automated payment systems have changed that for the worse.

It is this tendency to overspend that has led to many American people dreading the winter holidays. In fact, a Lending Tree survey suggested that as many as 61% of people—over half of the population—did not look forward to Christmas due to this expectation to splash out and overspend. This can cause as many as one in three adults to even lose sleep over the stress of the situation, with the sleep deprivation only making their stress worse in time as well.

The Numbers Don’t Lie

You may not realise quite how much you spend over Christmas, but the figures can be quite shocking. In fact, the average American family with children living at home under the age of 18 can expect to spend nearly $1000 on Christmas festivities! Families without young children don’t fare much better, with the average cost of their festive season being just over $600—extortionate costs for just a few days!

Facing Debts After Christmas

Due to the aforementioned costs of Christmas, it is unsurprising that some people end up in debt as a result of overspending. In fact, approximately 25% of people believe that they will be facing a debt of some sort once the festivities are over, but that’s not all. As well as this, 20% of people claim that they expect to still be paying off debts from the previous year’s celebrations by the time that Christmas rolls around.

Changes to Make this Year to Avoid Debts

There are a few changes you should make to be confident that you won’t be losing money this Christmas. After all, the statistics are staggering; however, you don’t need to fall into the overspending trap this Christmas. It is so instilled in you to overspend as soon as the first Christmas songs start playing, but with a little care and attention, you can make sure that you have a happy and debt-free Christmas this year!

- Shop around, and never buy on a whim; good deals really are too good to be true!

- Choose a budget for every aspect of Christmas and stick to it.

- Buy things in person and use cash—this will help you appreciate how much you are spending on your Christmas shopping.

- Get help from a qualified therapist if you feel like overspending is something you cannot face alone.

- Try discount codes—there are many different websites that offer coupon matching services nowadays, so why would you not?

- Enjoy your time with your loved ones; Christmas is about so much more than just giving gifts, after all!